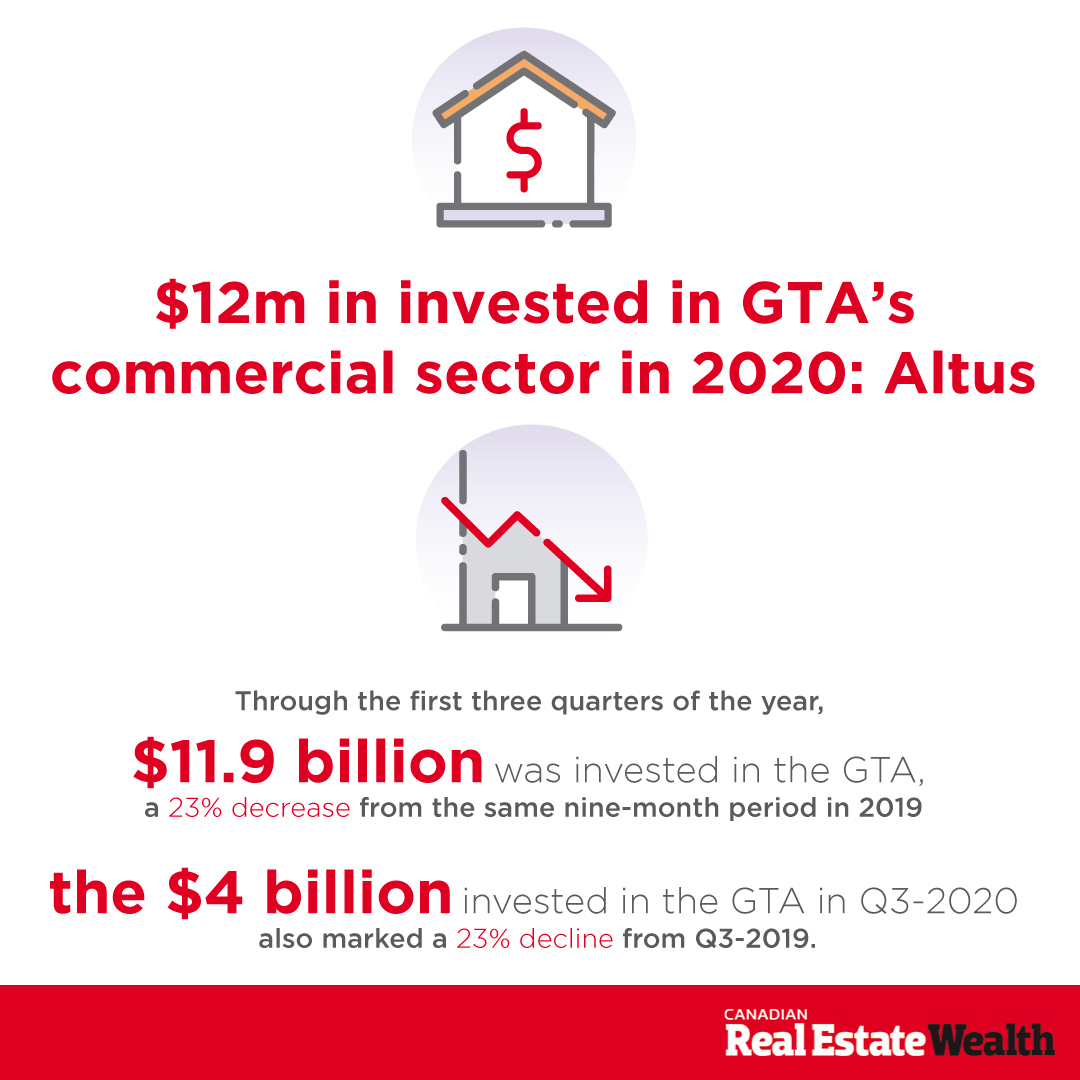

Investment volumes in the Greater Toronto Area’s commercial real estate market decreased year-over-year in Q3-2020, but, along with Montreal, the region remains investors’ Canadian market of choice, according to report from .

Through the first three quarters of the year, $11.9 billion was invested in the GTA, a 23% decrease from the same period in 2019; the $4 billion invested in the country’s most populous metropolitan region last quarter also marked a 23% decline from Q3-2019. The report noted that, at $1.1 billion, the —comprised of the , commercial and investment sector, as well as residential land and lots—was the only one to surpass the billion-dollar mark in the third quarter, with $665 million coming from the industrial space. This was followed by the apartments sector at $575 million.

Among the most significant transactions during the quarter, according to Altus Group’s report, were Signet Realty’s sale of seven multi-residential assets to Starlight Investments and Timbercreek Asset Management—the former acquired 386 units for $113 million and the latter received 289 units for $80 million.

Additionally, 277 Wellington St. W. was acquired by Reserve Properties and Westdale Properties through a joint venture, and at $78.5 million, the nine-storey 100,000 square foot building is considered by Altus to be the largest office transaction in the GTA during Q3-2020. The group also believes the site could be a lucrative infill site in the next few years.

The report mentioned that the retail and office sectors had difficult third quarters because of the COVID-19 pandemic, opening the door for greater sums of investment in the GTA’s industrial and multi-residential sectors, which have both withstood underwhelming market conditions rather well. Moreover, while the pandemic has catalysed a lot of turmoil in the market, it’s also the reason interest rates have fallen to all-time lows, which investors are leveraging with abandon.

Neil Sharma is the Editor-In-Chief of Canadian Real Estate Wealth and Real Estate Professional. As a journalist, he has covered Canada’s housing market for the Toronto Star, Toronto Sun, National Post, and other publications, specializing in everything from market trends to mortgage and investment advice. He can be reached at neil@crewmedia.ca.