According to an Edge Realty Analytics report, The Edge Report – March 2024, there are some notable trends being experienced by mortgage lenders that may have impacts beyond the banking sector.

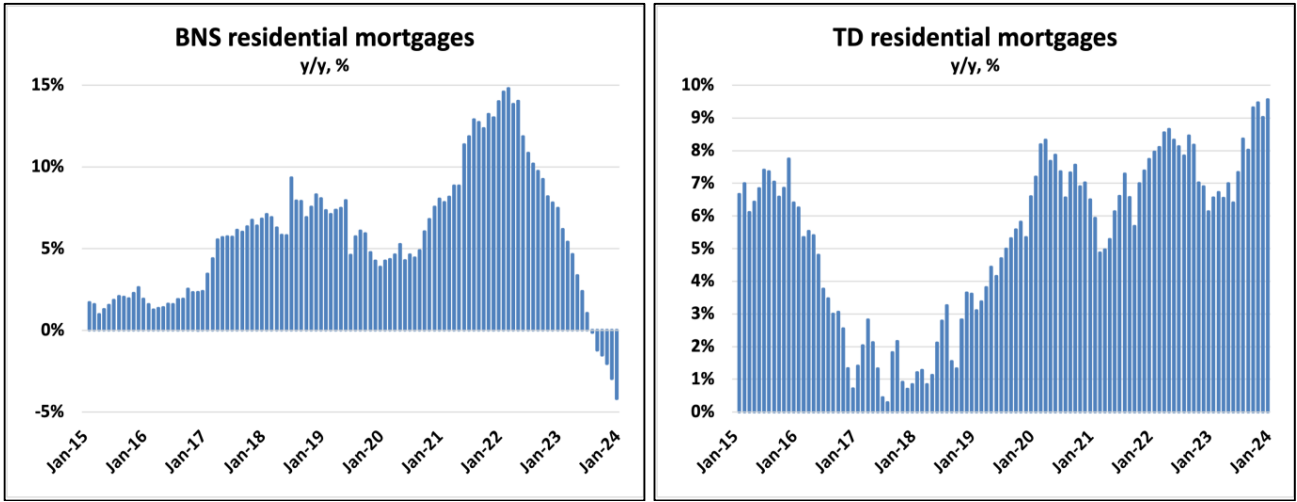

TD and BNS: Opposite Trends

The growth trajectories of two major Canadian banks, TD and BNS, are currently diverging dramatically in regards to their residential mortgage loan portfolios. BNS is experiencing a significant contraction, with its residential loan book shrinking at a rate of nearly 5% annually, for a very pronounced decline. In the opposite direction, TD has achieved a new decade high with a robust 9.6% year-on-year loan growth in this sector.

The pronounced decline in BNS’s residential mortgage portfolio can be attributed to various individual factors, so the trends experienced at BNS may not be indicative of broader-reaching impacts. These factors include recent senior management changes and debt and funding challenges. However, the broader banking industry is likely to have taken notice of TD’s approach which has given TD a robust presence and competitive rates within the broker channel. The TD strategy could be seen as a pathway to growth in current economic situations. BMO now seems to be trying to emulate TD’s successful model, hoping to achieve similar successes.

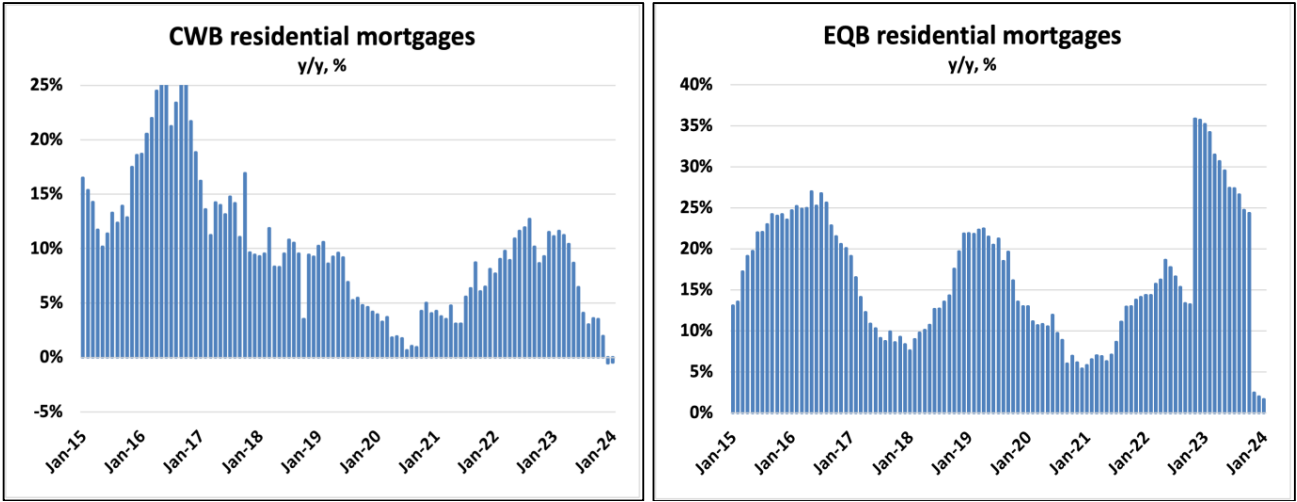

Non-Prime Lending

Major non-prime lenders like Equitable Bank (EQB) and Canadian Western Bank (CWB…via their Optimum arm) continue to see loan growth slowing. In the case of CWB, it’s now negative on a y/y basis while at EQB it’s barely positive on an annual basis and has declined over the past 6 months:

Meanwhile, non-prime lending organizations such as Equitable Bank (EQB) and Canadian Western Bank (CWB) through its Optimum branch, are experiencing a slowdown in loan growth. CWB has performed negatively on a year-over-year basis now, while EQB’s growth, though slightly positive annually, has dropped over the past six months.

This trend suggests significant challenges within the non-prime lending sector, with potentially weakening demand. Demand is also likely to continue weakening, as self-employed demographics, including professionals in real estate-related industries, such as contractors, realtors, and mortgage agents may be expected to be impacted by ongoing difficulties in securing mortgages.

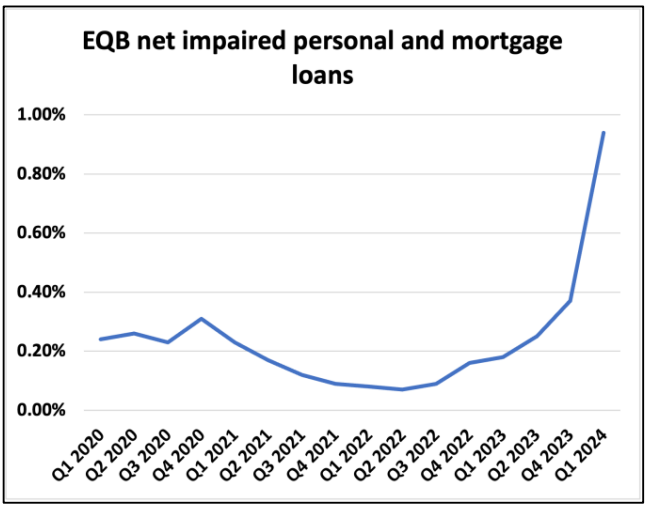

Additionally, Equitable Bank has experienced a nine-fold surge in net impaired personal and mortgage loans over two years, indicating heightened risk in this segment. Net impaired loans are the total value of loans to individuals experiencing payment difficulties or at risk of default, adjusted for provisions set aside to cover potential losses, and offer insights into credit risk management and potential financial stability concerns.

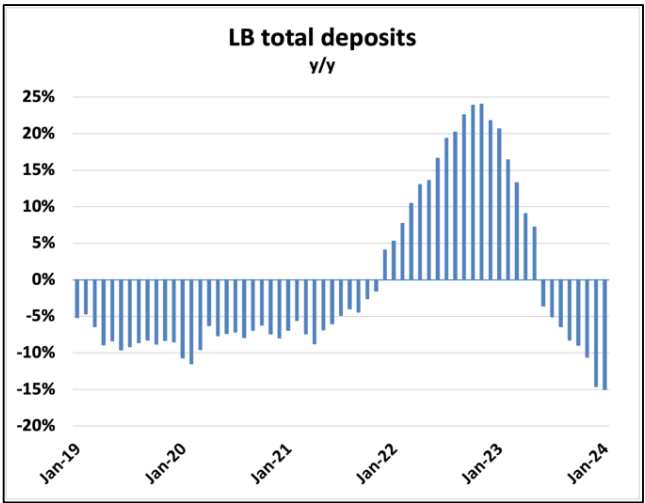

Laurentian Challenges

Laurentian Bank is facing a tumultuous period, characterized by a notable loss of deposit accounts. Following a major outage incident that precipitated the removal of the CEO and chairman of the board late last year, the bank’s reputation has suffered, eroding the trust of its client base. This loss of confidence led to a 3.8% decline in total deposits in the past three months and a 15% drop over the past year. Consequently, Laurentian Bank’s shares have also dropped by 15% over the past six months and nearly 40% over the preceding two years.