A new federal program designed to help middle class families get on the housing ladder is being introduced while the previously announced Shared Equity Mortgage Provider Fund will launch next month.

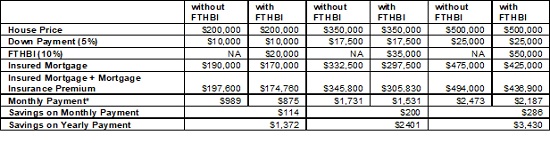

The federal government has announced that the First-Time Home Buyer Incentive will reduce monthly mortgage payments for first-time buyers without increasing their down payment.

The incentive will allow eligible first-time homebuyers who have the minimum down payment for an insured mortgage with CMHC, Genworth or Canada Guaranty, to apply to finance a portion of their home purchase through a form of shared equity mortgage with the Government of Canada.

For existing homes, the incentive will be 5% while for new homes there will be a 5% or 10% option. The larger share available for new homes aims to boost housing supply.

The program will launch on September 2, 2019, with the first closing on November 1, 2019.

“The First Time Home-Buyer Incentive is designed to benefit those who need more assistance with housing costs, middle class Canadians. Thanks to mortgage payments that are more affordable, many families will have hundreds of dollars more each month in their pockets – money to spend on things like healthy food, sports activities for their kids, or even save for the future.” said Bill Morneau, Minister of Finance.

The government has clarified that:

- Doubling the incentive for purchasers of new homes encourages new housing supply.

- No on-going repayments are required, the incentive is not interest bearing, and the borrower can repay the incentive at any time without a pre-payment penalty.

- The government shares in the upside and downside of the change in the property value.

- The buyer must repay the incentive after 25 years, or if the property is sold.

- The incentive will be available to first-time homebuyers with qualified annual household incomes up to $120,000. At the same time, a participant’s insured mortgage and the incentive amount cannot be greater than four times the participant’s qualified annual household income.

|

without FTHBI |

with FTHBI |

without FTHBI |

with FTHBI |

without FTHBI |

with FTHBI |

|

|

House Price |

$200,000 |

$200,000 |

$350,000 |

$350,000 |

$500,000 |

$500,000 |

|

Down Payment (5%) |

$10,000 |

$10,000 |

$17,500 |

$17,500 |

$25,000 |

$25,000 |

|

FTHBI (10%) |

NA |

$20,000 |

NA |

$35,000 |

NA |

$50,000 |

|

Insured Mortgage |

$190,000 |

$170,000 |

$332,500 |

$297,500 |

$475,000 |

$425,000 |

|

Insured Mortgage + Mortgage Insurance Premium |

$197,600 |

$174,760 |

$345,800 |

$305,830 |

$494,000 |

$436,900 |

|

Monthly Payment* |

$989 |

$875 |

$1,731 |

$1,531 |

$2,473 |

$2,187 |

|

Savings on Monthly Payment |

$114 |

$200 |

$286 |

|||

|

Savings on Yearly Payment |

$1,372 |

$2401 |

$3,430 |

|||

“Through the National Housing Strategy, more middle-class Canadians – and people working hard to join it – will find safe, accessible and affordable homes. Our proposed measures will reduce the monthly mortgage for your first home by up to $286. This will mean more money in the pockets of Canadians and will help up to an estimated 100,000 families across Canada,” added Jean-Yves Duclos, Minister of Families, Children and Social Development and Minister Responsible for Canada Mortgage and Housing Corporation.

Shared equity fund

As announced in Budget 2019, the government is also introducing the Shared Equity Mortgage Provider Fund, a five-year, $100-million lending fund to assist providers of shared equity mortgages to help eligible Canadians achieve affordable homeownership.

The fund will launch on July 31, 2019 and will be administered by CMHC. It will support an alternative homeownership model targeted at first-time homebuyers, help attract new providers of shared equity mortgages and encourage additional housing supply.

Steve Randall has more than three decades of media experience encompassing online, newspapers, magazines, radio, and podcasts. He focuses on insights and news for professionals in finance, real estate, and legal services. Steve writes for multiple Key Media titles in Canada, United States, Australia, and New Zealand.