The recent announcement by the Office of the Superintendent of Financial Institutions (OSFI) regarding loan-to-income (LTI) limits in Canada has caused people to wonder about the implications. These new regulations aim to restrict the proportion of new mortgages with loans exceeding 450% of borrower income.

OSFI has not yet provided clear guidance on the exact proportion of loans exceeding 450% of borrower income that banks are expected to adhere to. Instead, OSFI plans to evaluate this threshold on a case-by-case basis, suggesting that each bank’s compliance will be assessed individually.

More information is expected to be released in the future; the regulations aren’t expected to be implemented until next year.

Potential Impact of LTI Limits

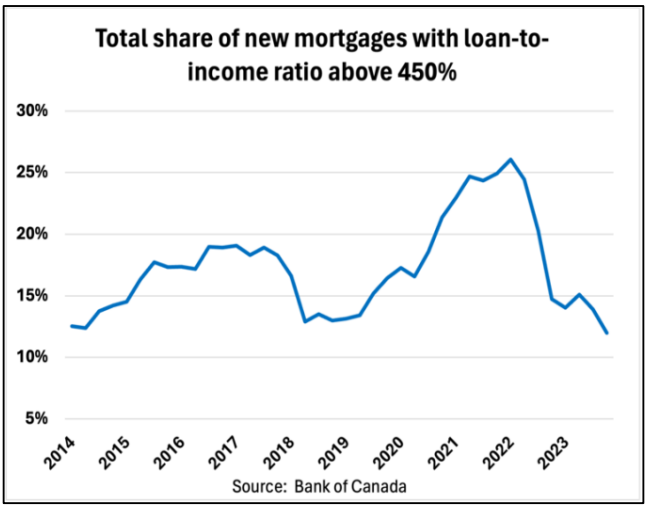

A recent Edge Realty report notes that because of the lack of specifics, however, it is hard to assess the impact. However, only 12% of new mortgages surpass the 450% LTI ratio, a notable decline from 26% in 2022.

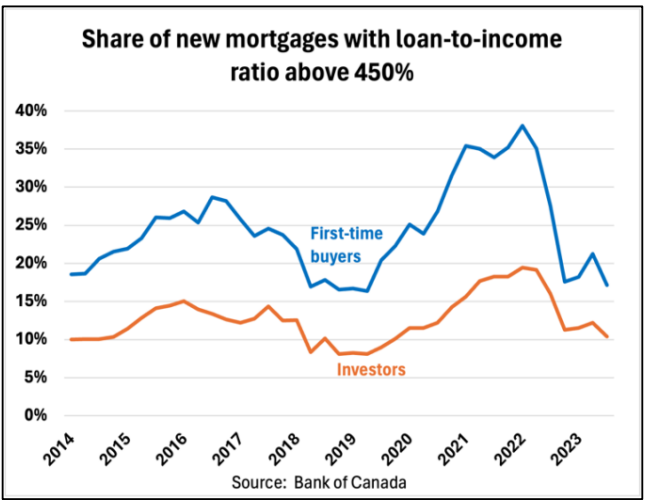

First-time homebuyers are likely to be among the most affected, since they are more likely to be highly leveraged borrowers. OSFI is requiring banks to include all forms of secured borrowing, including HELOCs and private mortgages, in their LTI calculations, which would increase the numbers impacted by the 450% limit. This inclusion could significantly impact investors and recreational property buyers, who may rely heavily on such financing methods for down payments.

Those exceeding the 450% LTI threshold may face higher interest rates as banks seek to mitigate perceived risks and navigate increased regulatory scrutiny. While getting more details from OSFI is important, the Edge report suggests this appears to be a modest tightening rather than a major change.

Related Household Debt Trends

Mortgage Declines

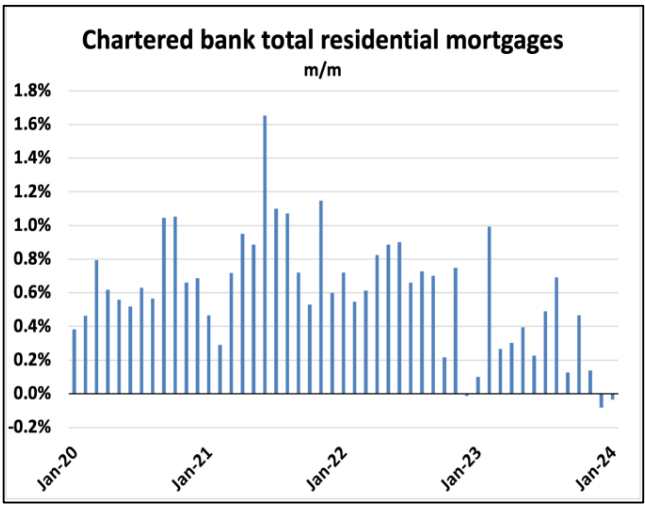

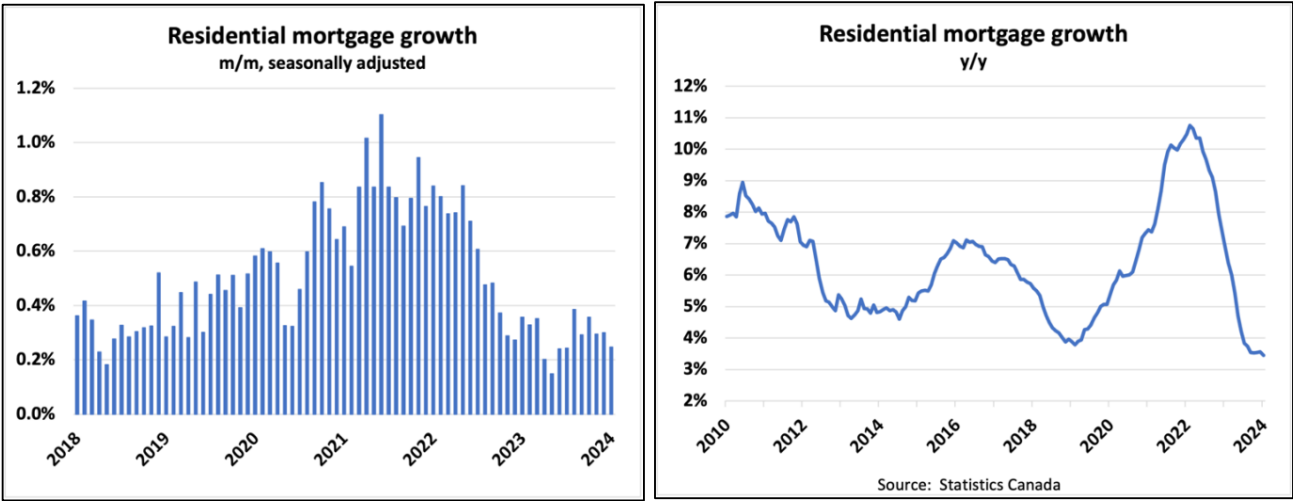

There are broader trends within the mortgage market, as well, including the first consecutive monthly decline in residential mortgages since 2016, which can be seen in non-seasonally adjusted numbers, highlighting the prevailing softness in mortgage demand.

The seasonally adjusted data is not significantly better, with residential mortgage credit outstanding numbers showing a mere 0.2% month-on-month increase in January, marking the lowest monthly rise since the previous summer. Furthermore, annual growth dwindled to a mere 3.4%. The Edge Realty report notes that, given these figures, when growth is the lowest it has been in decades, tightening mortgage regulations seems redundant.

Source: Edge Realty Analytics – The Edge Report March 24

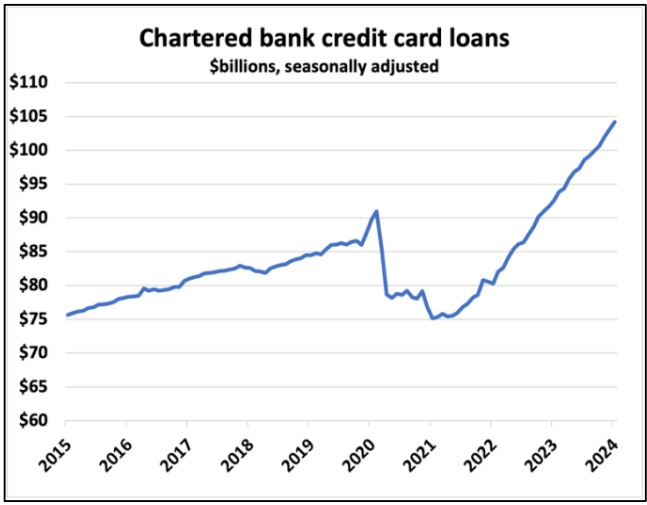

Credit Card Concerns

The report also suggested that a better area to target for mitigating risk is escalating credit card balances, which surged by an additional 1.1% on a seasonally adjusted basis in January, and shows a rate five times higher than that of mortgage balances’ growth. There are other signs of deterioration in credit card trends, as well. February card trust data indicated significant sequential increases in net charge-offs across all trusts. At the same time, there was also a slight rise in delinquencies across all reporting trusts.

Source: Edge Realty Analytics – The Edge Report March 24

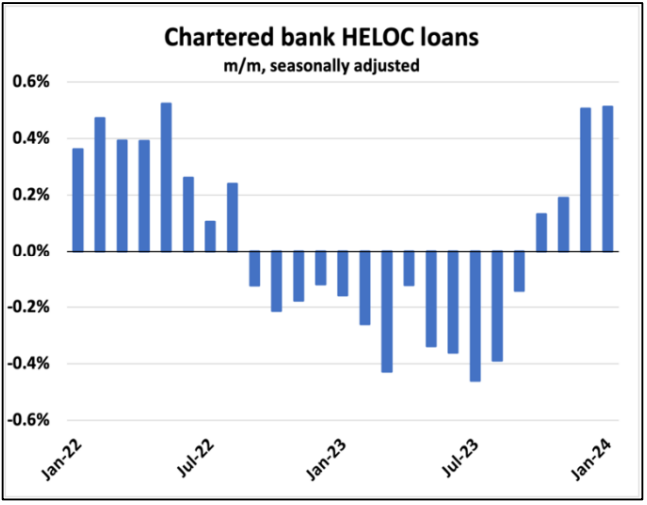

Rising HELOCs

After steadily decreasing since mid-2022, HELOC balances are rising again. This resurgence is noteworthy at this time, given the current economic context of a cooling economy. The fact that HELOC balances are increasing during this economic slowdown raises questions and concerns about the increase in debt reliance.

Source: Edge Realty Analytics – The Edge Report March 24

Given the declining mortgage demand and rising credit card and HELOC balances, there are signs of increased financial strains. In terms of the LTI regulation impacts, it appears more people are waiting to take on a mortgage at this time, anyway. However, the restrictions may have an impact on those increasing numbers with HELOC loans. Again, as more information comes out, the impacts can be more accurately assessed.