Rate markets have been stable in recent weeks; the Bank of Canada rate announcement on March 6th seemed to maintain that, with a decision to hold rates steady. The Bank of Canada noted indications of wage pressures easing. The Bank of Canada will release its Summary of Deliberations for this decision on March 20th.

However, according to a recent report from Edge Realty, the expectations for 75 basis points (0.75%) of rate cuts this year, with the first cut expected next month, may not be sufficient.

The report suggests that the economy is cooling at a much faster pace than what the BoC acknowledges, predicting rate cuts closer to 1.50% this year, as well as significant deliberations in the fall regarding the need for 50 basis point rate reductions at the October or December meetings.

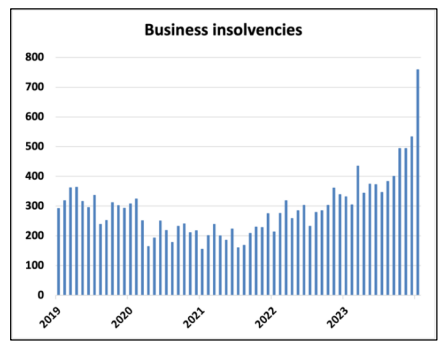

Business Insolvencies

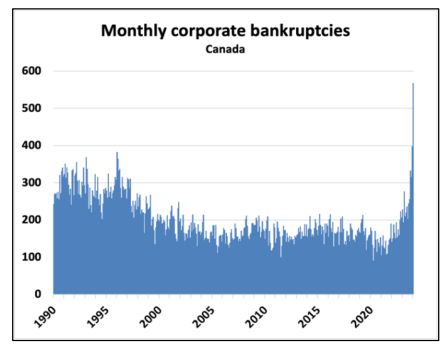

These predictions stem from the fact that businesses are encountering notable obstacles. Business insolvencies surged in January to the highest levels seen since 2006. The CBC reports that business insolvencies increased by more than 41% last year. If focussing on corporate bankruptcies specifically, as part of overall business insolvencies, the figures are exceptionally high, surpassing conventional charts and measures.

Source: Edge Realty March 2024 Metro Deep-Dive

Source: Edge Realty March 2024 Metro Deep-Dive

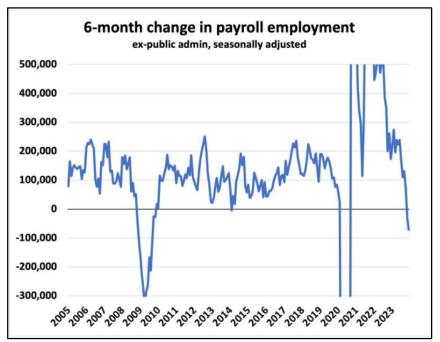

Labour Market Downturn

Another factor contributing to these predictions is the evident downturn in the labour market. Whenever business operations start shutting down over an extended period, it is reflected in the labour market. Current issues in the business sector are starting to show; private sector payrolls have decreased over the past six months, marking the first such decline since the pandemic lockdowns and even preceding that, the 2008 financial crisis.

Source: Edge Realty March 2024 Metro Deep-Dive

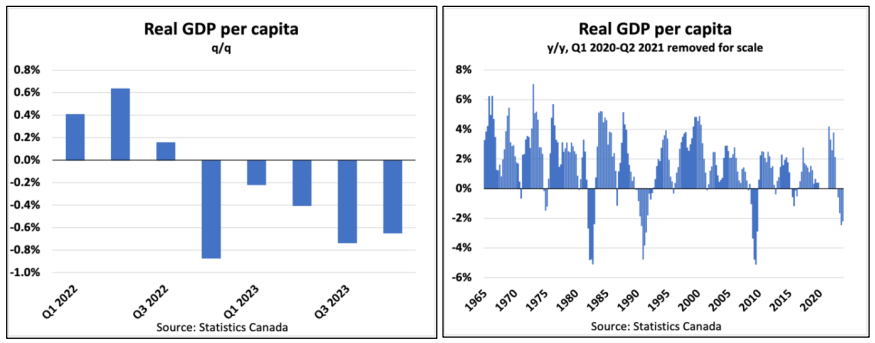

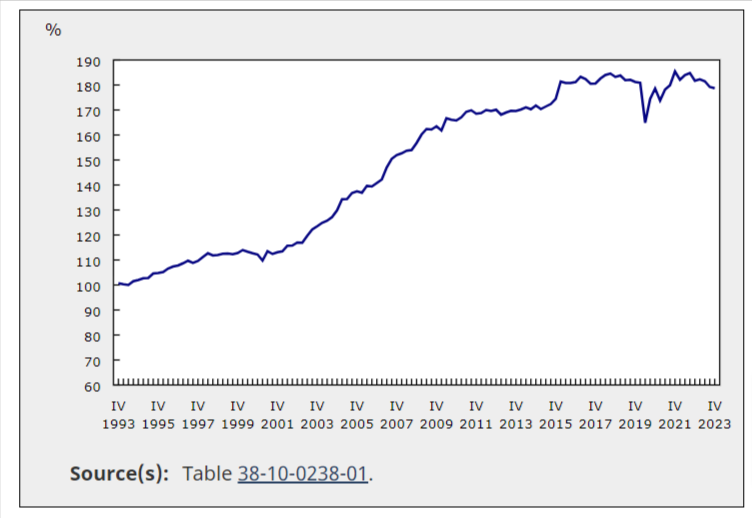

Falling Per Capita GDP

Canada has also experienced five straight quarters of declining per capita GDP; additionally, it is falling at an annual rate that has prefaced a recession in the past.

This indicates that the entirety of the growth observed in headline GDP is due to an expanding population rather than an increase in output per individual. While this would be acceptable if it were possible to maintain population growth within the 3% range, it is unlikely that the necessary growth of 800,000 non-permanent residents will happen, given the current federal government measures to restrict study and work permit programs which drive non-permanent resident growth. A reduction in population growth within the next 18 months, which is likely, would eliminate a significant boost to GDP growth.

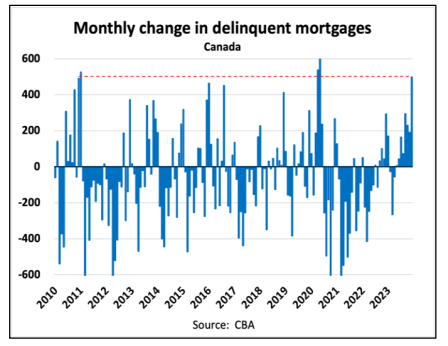

Mortgage Delinquencies

Mortgage delinquencies are on the rise, and the Edge Realty report predicts mortgage delinquencies to more than double over the next year to year and a half, bringing the arrears rate back to long-term norms.

In December, the arrears rate had risen from 0.17% to 0.18%, for the highest monthly increase since April and May of 2020, or previously, since 2011.

Credit Card Debt

Credit card debt is also on the rise.

The report concludes that significant developments are occurring, and predicts that by late spring, it will become increasingly apparent that the Canadian economy is not sustainable with rates at their current levels, which may prompt a shift in expectations towards rate cuts.