Looking to buy a house in Canada?

Before applying for a mortgage pre-approval, you should check your credit score in order to ensure you can be approved for a mortgage in the first place. The bottom line is, the lower your credit score is, the more consequences you’re likely to experience. This is why, even if it may take longer than expected, you may want to hold off on buying a house until your low credit score is resolved and we’ll get into why below.

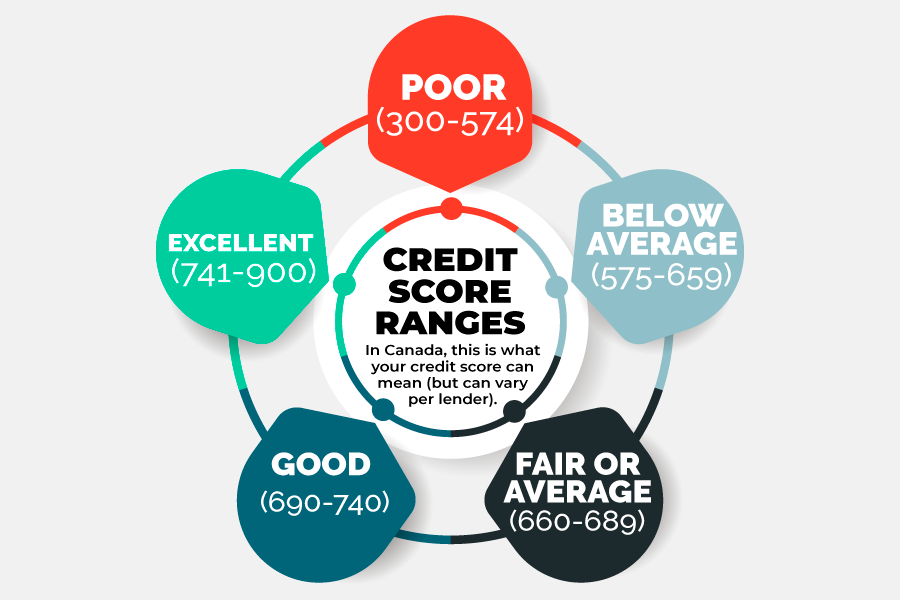

Credit score ranges

Having bad credit can not only make it difficult to obtain a mortgage loan, but it can also raise the amount of interest you pay on a loan. Poor credit can deem you a “high-risk lender” by financial institutions if you seem more likely to default on mortgage payments.

In Canada, this is what your credit score can mean (as it will vary per lender):

Poor (300-574)

You may not actually get approved for a mortgage by a traditional lender with a poor credit score, however, every lender will have a different set of requirements. If a lender does approve you, your interest rate will be much higher and if you default on too many mortgage payments, you could lose your home. And it’s not just getting a mortgage that will be an issue. You’ll also find it difficult to get approved for lines of credit or other personal loans.

Below Average (575-659)

Even though your credit score isn’t “poor”, you may still have to pay higher interest fees with a below-average credit score.

Fair or Average (660-689)

Your payment history may be a little rocky but not quite as bad as those with a lower credit score, but lenders may still deem you riskier than others, so you can still expect higher interest rates.

Good (690-740)

With a good credit score and a good reputation with your credit bureau, you won’t have trouble getting a mortgage or other types of loans like a line of credit, personal loan, or car loan. If you pay off your debts like your credit cards on time every time, it won’t take long to build a good credit score. Plus, with a higher credit score, you’ll have lower interest rates.

Excellent (741-900)

With an excellent credit history and score, lenders won’t have any hesitation when it comes to approving you for a mortgage loan. A perfect credit score is rare, but definitely not impossible. The higher the credit bureaus rank your score, the lower the interest rate you’ll have to pay, so it’s worth trying to improve your score before applying.

So … can you get a mortgage with a credit score of 600?

Does a poor credit score mean that you won’t be able to obtain a mortgage? Not necessarily. The loan may just have to come from somewhere other than a traditional lender (bank). Luckily in Canada, there are other (non-traditional) credit unions you can turn to. These types of places can help people with mortgage approval, especially if they can’t get it at traditional credit bureaus, like TD Bank, RBC, BMO, etc. They’re typically owned by individuals and are much more forgiving for people with lower credit scores and a lower income. They can offer lower interest rates and just lower fees in general.

There are also non-bank lenders that can accommodate your specific needs, like Loans Canada, Easy Financial, Fairstone, and many more. We know you’ve probably asked the question “is a non-traditional lender safe?” before, and yes, they are safe and secure. Both traditional and non-traditional lenders must comply with the same rules. In fact, in July 2019 in Canada, it was reported that non-bank lenders were the go-to for mortgages rather than traditional lenders. And it’s important to note that these mortgage loans weren’t just for those with bad credit scores. They can be a great place to lean on for those who are self-employed, single, going through a divorce, have health problems, and other issues.

How a credit score is determined

If you’re trying to buy a home in Canada, there are a few factors you should become familiar with when it comes to your credit history before applying for a mortgage. You may want to improve your credit score first so you have a better chance at obtaining the mortgage loan amount you want.

Your credit score isn’t just based on paying bills on time (although that’s largely where your score comes from). Other factors come into play, too, such as:

- How long you’ve had a credit history

- Other loans under your name (car, personal, line of credit, etc.)

- Your balance-to-credit-limit (the available credit you have compared to the maximum credit limit) Any history of bankruptcy (which can stay on your account for several years)

- How often you miss payments

- Your current debt

- How many credit card accounts you’ve opened

- The number of credit inquiries (yes, every time an application is submitted for a credit score check, this will slightly impact your score)

- How to check your credit score

Every financial lender will have a different credit score method and means of checking your credit report. Some may offer free credit score checks whereas others may require you to apply for one. You can also rely on other companies like Equifax® to send you regular monthly credit reports so you can stay on top of your credit score, especially if you’re hoping to improve it for mortgage approval purposes.

How to improve your credit score, fast

Again, a “good” credit score is considered anywhere from 690 and up, but remember, this will depend on the lender’s score rating as every financial institution’s score system will vary. For example, according to Equifax®, a good credit score can be 670+. Regardless, having a good credit score can make a huge difference when you’re in need of a loan, particularly when it comes to obtaining a fair mortgage rate and interest rate.

Before applying, consider the following methods right away so your score can improve:

Pay all your bills on time

Even just one late payment can affect your credit score, so imagine what frequent late payments can do. Every bureau will vary, but typically late payments will show up on your credit report 30-60 days after it’s due. This can build up faster than you think, therefore, you should work on paying off your credit card debts and other loan payments first to make them as current as possible.

Make sure not to use your credit limit

Just because you have a high credit card limit doesn’t mean you have to use it. Actually, in order to prevent the temptation, ask your bank to lower it. Typically for lenders, an ideal credit utilization ratio is 30 percent. You can easily figure this out yourself by dividing your credit balance by your credit limit.

Make frequent payments

Making frequent payments is just as important as paying bills in a timely manner. Rather than waiting until your bills are due every month, make micropayments when you can. Every little bit helps make a difference in the end.

Don’t apply for any new loans unless absolutely necessary

We know it may be tempting to apply for another loan to take a trip around Europe next summer, but if your dream is to obtain the mortgage you’ve always dreamt of, you gotta do what you gotta do! Sometimes this is done by keeping your loan borrowing to a minimum so you’re not hurting your bad credit score even more.

Don’t keep applying for a credit report

As mentioned above, it’s best not to inquire about your credit score too much as this can negatively impact the score. A hard inquiry (when a lender is deciding whether or not they want to provide you with a mortgage loan) can actually remain on your credit score for two years.

Dispute errors as soon as possible Staying on top of transactions on your credit cards is important, especially since it’s 2020 and, unfortunately, stealing information is much easier nowadays. An unnoticed issue could actually be bringing your score down. Let your bank know as soon as you notice something fishy so they can have it taken off your report.

Don’t close your unused accounts

You may think that having multiple accounts open is ruining your score, and while this can ring true in a way (especially if payment is late) closing those accounts actually causes you to lose that credit overall which, in turn, will lower your credit score even more.

Before you apply for a mortgage

Ultimately, before you apply for a mortgage or even mortgage pre-approval, you should consider checking your credit score to ensure that lenders will actually provide you with a fair mortgage rate and interest rate. The better your score, the better chance you have at obtaining the mortgage you’ve always wanted to snag your dream home.

Otherwise, if you’re seen as a high-risk lender who is likely to default on your monthly mortgage bill, lenders will charge you premium interest rates.

If you’re someone who has bad credit, is going through a divorce or is currently single, or maybe you’re considered self-employed and having a hard time convincing lenders you’re an ideal mortgage loan borrower, you might want to opt for a non-traditional lender for a better shot at getting the mortgage you want, but also at an affordable rate. Non-traditional lenders are just as safe and secure as traditional lenders and have become quite the popular choice amongst Canadian homeowners.

If owning a home is your dream but you have a low credit score, don’t fret. You can build it back up again so you can obtain a mortgage loan that you desire. It won’t always be easy, but it’s worth the effort in order to snag your dream home! Just keep paying your bills, worry about other debts first before applying for a mortgage, don’t apply for other loans unless absolutely necessary, and keep your accounts open in order to keep your credit score up. You don’t need a perfect credit score to get a mortgage in Canada, but it is suggested that the minimum credit score you should have is 600+ and that most traditional financial lenders will favour those with a credit score of 690 and up.