Canada’s rental market witnessed another drop in average vacancy rates in 2019, hitting its third consecutive year of decline mostly due to the drop in Montreal, according to Canada Mortgage and Housing Corporation (CMHC).

The decline in vacancy rates was due to the robust rental demand that continued to outpace the current supply, particularly in the unit segment. The vacancy rate for all bedroom types across Canada was at 2.2%, the lowest it has been since 2002.

“This downward pressure on vacancy rates emphasizes the need for increased rental supply to ensure people throughout Canada have access to affordable housing,” CMHC said.

One of the most notable declines was in the Montreal Census Metropolitan Area (CMA), where vacancy rates hit a 15-year low at 1.5%. The decline in the Montreal CMA was amongst the biggest drivers of the national decline. This came with a 3.6% increase in average rent to $841.

“Changes in Montreal’s vacancy rate have large impacts at the national level because 28.8% of all purpose-built apartment units in Canada are in Montreal. This exceeds the shares represented by Toronto at 15.4% and Vancouver at 5.4%,” CMHC said.

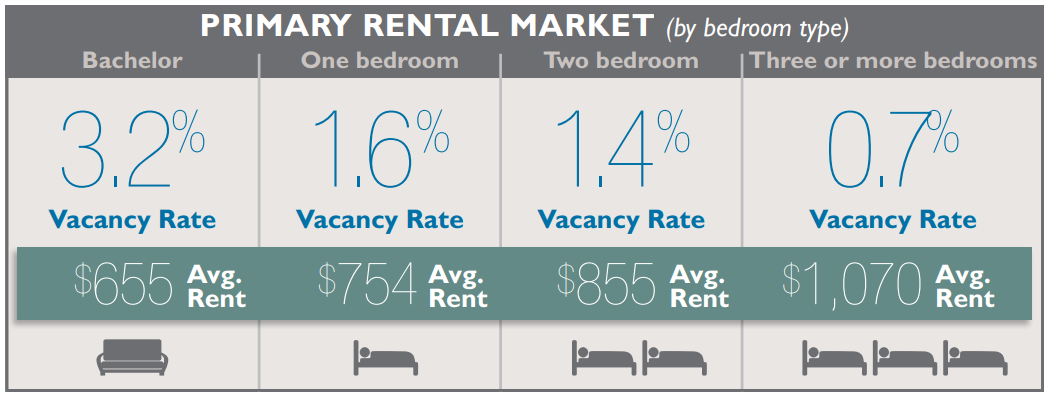

The graphic below shows the region’s vacancy rates and average rents in terms of bedroom type:

Francis Cortellino, an economist at CMHC, said the demand for rental units in Montreal CMA was sustained mainly by the increase in migration.

“In particular, there was a strong rise in net international migration, especially in the non-permanent resident category, and a slight decrease in the interprovincial migration deficit. It is probable that most non-permanent residents, such as foreign students and temporary workers, choose the rental market when they arrive, thereby greatly stimulating rental demand,” he said.

The homeownership patterns of Montreal households aged 35 and below also influenced the demand. Cortellino said the proportion of renters in this age group has been increasing since 2016.

“This situation has apparently continued since then, given the pronounced rise in house prices on the Montreal market in recent years,” he said.