If you’re familiar with Stephen Covey’s bestseller, Seven Habits of Highly Effective People, you’ll know one of his tenets is “begin with the end in mind.” We can apply the same principle to real estate investing. Knowing where your own personal exits are located is not only good for piece of mind and effective long-term planning, but it also prepares you for a variety of potential outcomes, allowing you to prosper in any situation.

When you move into commercial investing, one of the most important considerations you’ll make is your exit strategy. As with any investment – whether precious metals, stocks or property – the exit strategy is the most important part of the buying process.

Let’s examine a few of the most popular exit strategies in commercial real estate investing, some of which can be applied to residential properties as well.

1. Profit on purchase

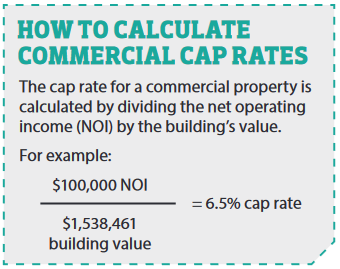

Ideally, you should profit on the purchase of an investment property. As an example, let’s consider a market area with an average cap rate of 6.5% on a small plaza (valued at $1.538 million at $100,000 NOI). Let’s say that, due to a lucky coincidence, you were able to buy a property at a 7% cap rate ($1,428,600). If the property is immediately resold at the market rate, that 0.5% difference in cap rate could bring in as much as $100,000 in gross profit on this property (minus closing costs).

I am in no way encouraging this type of investment – I believe in long-term planning – but this is a good option to consider if you’re aggressive and don’t mind the risk involved.

2. Add value

Adding value can apply to almost anything, from swapping out regular lightbulbs for LEDs to adding another story or two to the property. The main idea is to reduce expenses and to increase the revenue generated by the property.

There are myriad out-of-the-box options you can attempt on a larger scale. For a retail plaza, for example, one popular way to create an additional stream of income is by converting part of its vacant land or parking lot into another drive-through/restaurant pad.

After successfully increasing revenue, you usually have two options: sell the property with the new, increased stream of revenue for a higher value, or refinance it, freeing up the capital used in the value-add process and keeping the property in your investment portfolio for many years to come.

3. Change the status and sell part of the property

This strategy works well in both residential multi-family properties and commercial/industrial multi-unit buildings. One way to implement it is to convert an existing property into a condominium corporation with separate titles for every unit. This process will depend on municipal bylaws and requires both legal help and a budget.

If successfully implemented, it will allow you to sell off several of the units to recover the cost of the purchase – and potentially pay it off completely while leaving enough units rented out to maintain a healthy cash flow. Your tenants might have an opportunity to buy the unit they’re occupying or stay on a lease.

The same general concept can be applied to a parcel of vacant or excess land. It can be subdivided into several parcels if the existing zoning allows, or it can be rezoned and then severed, preparing it to be sold off or built upon at a later date.

4. Change the use

The most adventurous exit strategy of all, change of use allows the owner of an underperforming property to increase income by converting all or a part of the property to another use (i.e. from commercial to residential).

It’s no secret that retail malls in North America have been hit hard by online shopping and are slowly filling with vacant space. Some mall owners have creatively tackled this problem by turning some of the retail and office units into short-term residential rentals.

A couple of years ago, I was approached by a person who owned a 16,000-square-foot commercial building on the main street of a medium-sized town in Ontario. The property was in good shape but had a problem. Two-thirds of the building had sat vacant for two years, and the holding corporation was taking losses. Initially, I would have tried to sell the property as is, but having seen the low level of interest, I proposed a change-of-use strategy to convert the existing vacant commercial space into residential suites.

After working with local planners and the municipality and following the minor zoning variance, we were able to receive a building permit for 12 residential units, while keeping the remaining third of the building commercial. As sometimes happens in smaller municipalities, we were even offered a small grant and a zero-interest loan for part of the construction cost.

Even after the additional construction costs, estimated at $800,000, our financial projection was showing an increase in net operating income from -$52,000 to $32,540 within a year of residential occupancy. But we never had a chance to test that projection. Interest in the project spiked when potential buyers were presented with the new numbers. We were able to sell the property before we started any work on it.

That’s the beauty of commercial real estate – if you have an open mind and a bit of creativity, the possibilities are endless. Just remember to put that creativity to work by establishing an intelligent and appropriate exit strategy before you start shopping for properties.

Kirill Perelyguine is a broker with Royal LePage Real Estate Services in Toronto, where he specializes in commercial investment properties and land development. Contact him at kirillp@royallepage.ca, or visit investingontario.com.

Kirill Perelyguine is a broker with Royal LePage Real Estate Services in Toronto, where he specializes in commercial investment properties and land development. Contact him at kirillp@royallepage.ca, or visit investingontario.com.