What Canadian mortgage debt can tell us about the economy.

For most Canadians in 2021, debt is a regular part of life. If you own a house, you likely have a large amount of debt in your mortgage as well as many smaller debts such as car payments, student loans, or credit bills. In 2021, total consumer debt in Canada rose above $2 trillion.

You might think of debt as your own personal responsibility, but you may be surprised to know it is also part of something bigger. You represent one component of the larger economy and, therefore, your debt is actually part of a larger measure that is known as the debt to income ratio.

The debt to income ratio is an important indicator not just for your own personal financial condition. It’s also used by analysts to measure the average condition of all Canadian’s financial situations as well as the condition of the Canadian economy as a whole. Especially as we start coming out of the pandemic-induced recession, economists are paying attention to the debt ratio to see how Canadians are handling changing economic conditions.

What debt to income ratios means for individuals

Your mortgage to income ratio is important for you personally because it represents how much of your income goes towards servicing your mortgage debts. When it comes to getting a mortgage, lenders will consider your gross debt service and , which are a measure that tells them how much of a . Lenders need to know you have a certain amount of income to not only afford your housing costs but to continue covering your mortgage or your financial situation changes.

What the debt to income ratio means for the economy

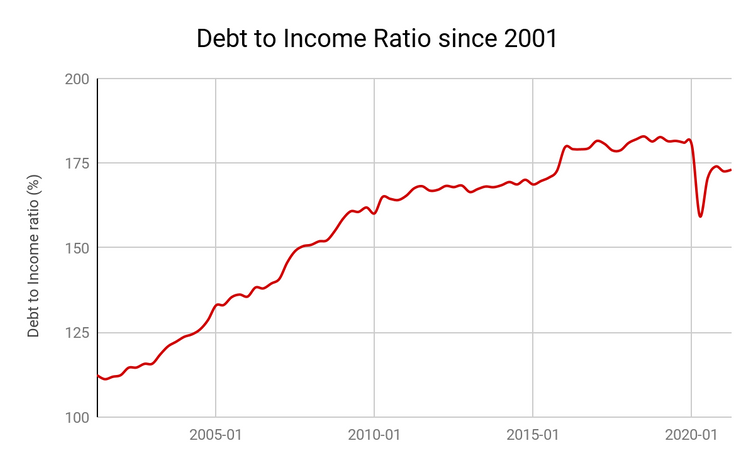

Beyond individual concerns, analysts track the average amount of income to debt ratio for all Canadians in order to know how the country as a whole is doing. The statistic for the debt to income ratio is expressed as a percentage representing the value of household debt compared to household disposable income. According to stats Canada, the average Canadian income to debt ratio for Q2 of 2021 was 173%. This means that the average Canadian household owes $1.73 for every dollar of income made.

This measure includes all debts that Canadians owe, of which mortgage debt only makes up one component. However, mortgage debt is one of the largest debts that most Canadians will take on and makes up a very large portion of the debt ratio. Of the over $2 trillion in consumer debt held by Canadians, .

Recently, with the growth of house prices accelerating, the amount of mortgage debt that Canadians are taking on per person is now higher than ever.

Another important figure to keep in mind is the debt service ratio, which is the amount of money it takes to service debts. Though the size of Canadian debt has risen, interest rates, especially mortgage rates, have fallen from decades earlier, which must be kept in mind when talking about debt affordability. The recent growth of housing prices was due in part to historically low mortgage rates, meaning the debt from more expensive homes is easier to service than would otherwise be the case with higher rates. The average debt service ratio for Canadians has remained relatively steady for a long time.

History and trends of the debt to income ratio

For the past few decades, Canadian household debt has been on an upward trend, however, there have been some small dips year to year. Most recently, the effects of the COVID pandemic actually caused the indebtedness of Canadians to drop significantly, reaching 159% in Q2 2020. A figure that low hadn’t been seen in over a decade until that point. The highest recorded Canadian debt ratio of over 182% occurred in Q3 of 2018.

The continuous increase of debt ratio hints towards the growing costs in the Canadian economy, while household income has not been able to keep up. The effects of the pandemic are hard to fully understand, but essentially the way that Canadians held and paid off debt was significantly altered during the start of 2020 as uncertainty loomed.

Why the ratio is rising

As opposed to something like the Consumer Price Index, there is no reason that the Canadian debt ratio needs to continuously grow. If household income and debt remained steady in proportion to one another, the ratio would stay constant despite inflating costs. The increasing trend of debt ratio then indicates a growing rift between Canadian household income and their debt expenses.

It can also indicate a changing attitude towards debt for Canadians. In general, it seems Canadians have become more comfortable with holding more debt and paying it out over longer periods of time.

Finally, it’S worth remembering that as a ratio, both components affect the final value. An increase can mean debts are going up but it could also mean income is going down.

What is the forecast for the debt ratio?

Though there was a dip in the debt ratio as a result of unprecedented conditions in early 2020, the ratio has now started to approach its pre-pandemic levels. It will likely remain lower as recessionary conditions wear off, but the trend of increasing debt is likely to continue into the future.

The reason that we should pay attention to a high debt ratio is that it warns of financial vulnerability for Canadians. This is essentially the same reason your lender wants to ensure you have favourable debt ratios before lending to you. Larger amounts of debt mean that the Canadian economy as a whole is more vulnerable to macroeconomic shocks and could be destabilized much easier.

That being said, it seems that the most recent challenges from the COVID pandemic were not the kind of shock that would cause major harm. While there were temporary hits to things like employment and mortgage arrears, both stats have now nearly returned to pre-pandemic levels.

Though Canadian debt is high, thanks in part to things like the mortgage stress test, Canadians have demonstrated to some extent that they are able to weather the storms of economic strain.

In fact, an increase in Canadian debt can potentially indicate optimism towards the future of the economy. When more Canadians are taking on debts, it indicates that they have confidence in their continued financial prosperity.

Overall, a recent rise in the debt ratio is an indicator of economic recovery for Canada as it emerges from the pandemic. However, on the larger scale, the upward trend of the debt ratio could be cause for concern should it continue to rise, or increase its pace.

Corben joined CREW as a relative newcomer to the field of real estate and has since immersed himself and learned from the experts about everything there is to know on the topic. As a writer with CREW, Corben produces informative guides that answer the questions you need to know and reports on real estate and investment news developments across Canada. Corben lives in Guelph, Ontario with his partner and their two cats. Outside of work, he loves to cook, play music, and work on all kinds of creative projects. You can contact Corben at corben@crewmedia.ca or find him on Linkedin at https://www.linkedin.com/in/corbengrant/.