According to a report from Edge Realty, as of February 2024, there have been significant positive trends in the prairies’ real estate market, and some especially notable trends in Edmonton’s market.

Sales

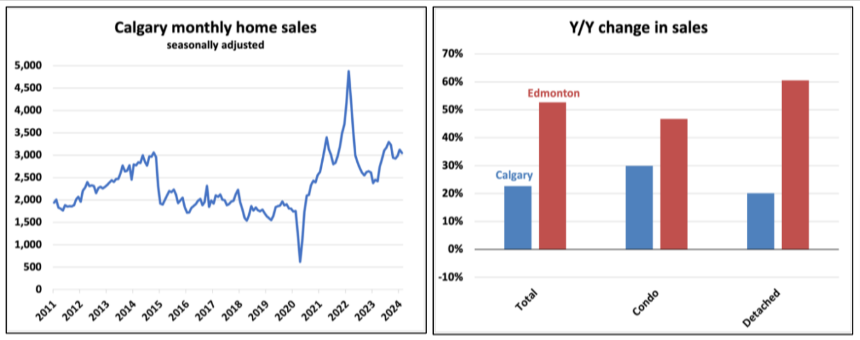

In Calgary during February, the market stayed strong, with an impressive 22% year-over-year increase. However, the most notable activity is in the Greater Edmonton Area, where sales surged significantly.

In February 2024, the Greater Edmonton Area real estate market witnessed a significant surge, with a total of 1,966 residential unit sales. This marks a notable increase of 36.9% compared to January 2024 and a substantial rise of 52.6% compared to February 2023.

This surge, along with other significant factors, may indicate promising prospects for Edmonton’s market.

Source: Edge Realty March Metro Deep Dive

New Listings

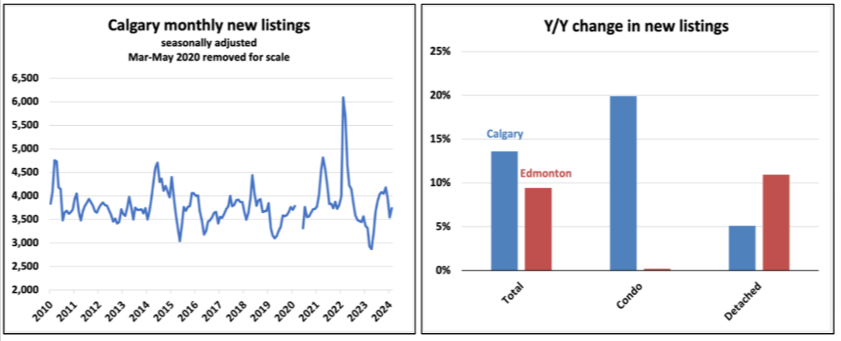

New listings remain stable, but well below normal levels across Alberta.

Calgary listings rose to 2,711, while there were 2,762 new residential listings in the Greater Edmonton Area, marking a 27.7% increase compared to January 2024 and a 9.3% rise compared to February 2023. The overall inventory in the GEA experienced a 5.8% increase from January 2024, although staying 14.3% lower than in February 2023.

Source: Edge Realty March Metro Deep Dive

Sales-to-New-Listings

Although the sales-to-new listings ratio in Calgary experienced a slight decline to 81%, the market remains highly active and robust.

Source: Edge Realty March Metro Deep Dive

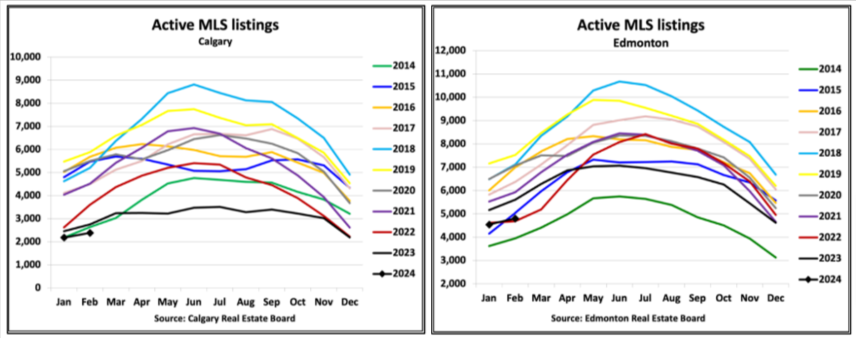

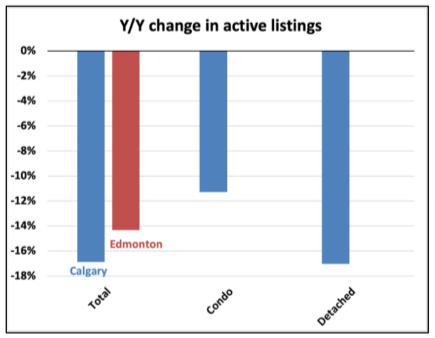

Inventory

Inventory is tight. In Calgary, inventory was 2,355, down 14.2% year-over-year, while in the GTA, overall inventory in the GEA was 14.3% lower than February 2023.

Source: Edge Realty March Metro Deep Dive

House Price Trends

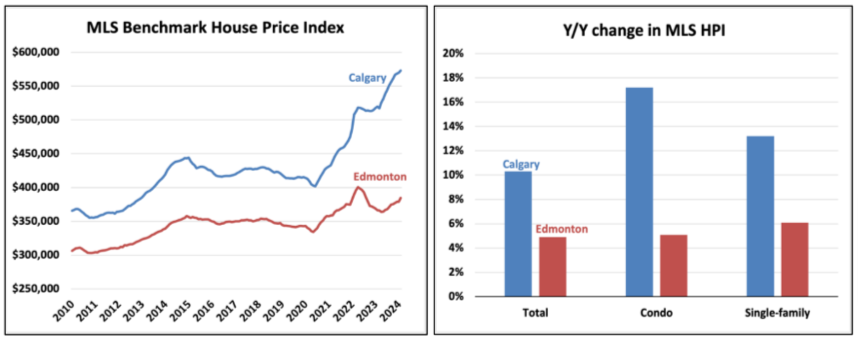

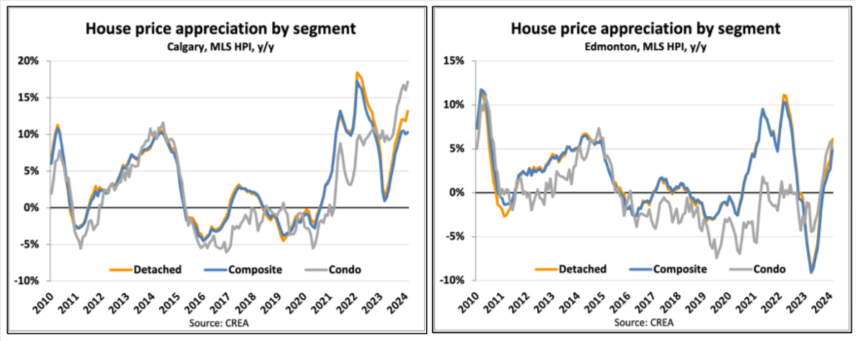

House prices in Calgary are on a continued surge, rising by over 10% year-over-year across the board, with the condo segment experiencing an even more significant increase of 17% and the biggest appreciation in 14 years, which has raised the question of whether this market is “frothy”.1

Additionally, the percentage of Calgary condos sold compared to other properties has grown to 30% as of January 2024, compared to 17% in January 2020. In January 2020, the average price was $234,969; in January 2024, it was $337, 011, for an 18.7% annual change, with a slight drop again in February 2024 to $332,295.

In the Edmonton area, the total average price for residential properties reached $407,458, marking a 2.3% rise from January 2024 and a large 10.4% increase from February 2023. Given the high demand and increased sales, plus low inventory, prices may be driven further up.

Source: Edge Realty March Metro Deep Dive

Construction Activity

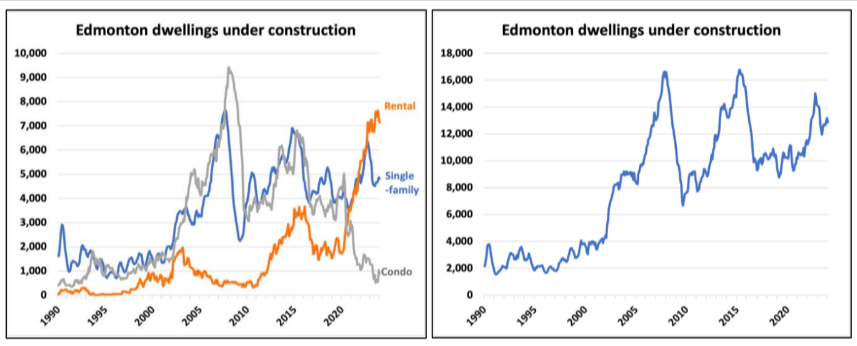

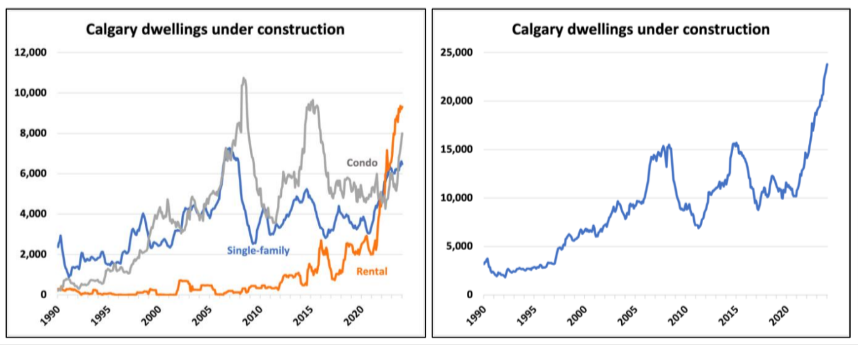

Construction activity is a key area where Calgary and Edmonton are trending differently.

Construction activity in Calgary is gaining momentum. In January, the number of dwellings in the pipeline increased by 1.3%, driven primarily by a 4.6% surge in condo construction. Compared to last summer, there are now 55% more condo units under construction. Although this increased supply won’t immediately impact the market, such swift construction activity suggests that within a year or so, the market will be much better supplied.

In contrast, construction activity in Edmonton is relatively subdued at present, especially if rentals aren’t being considered.

Source: Edge Realty March Metro Deep Dive

It appears that Edmonton is poised to take the lead in sales and price increases, although Calgary’s outlook remains fairly positive. However, with Edmonton experiencing a remarkable 50% year-over-year increase in home sales, a 14% decrease in resale inventory, and the lowest level of construction activity, excluding rentals, since the early 2000s, Edmonton’s market may be poised for significant growth in the short term.