The price of an average home in Canada increased by just 2.7% year-over-year in the first quarter of 2019 – a sign that the housing market may experience significant slowdown in the months ahead.

According to Royal LePage’s House Price Survey, which compiled property data in 63 of Canada’s largest real estate markets, the sluggish increase in home prices was well below the long-term norm of approximately 5%. Broken down by housing type, the median price of a two-storey home rose by only 2.6% year-over-year to $729,553, while the median price of a bungalow rose 1.1% to $513,497. Meanwhile, condominiums remained the fastest growing housing type on a national basis, rising 5.4% year-over-year to $447,260.

Read more:

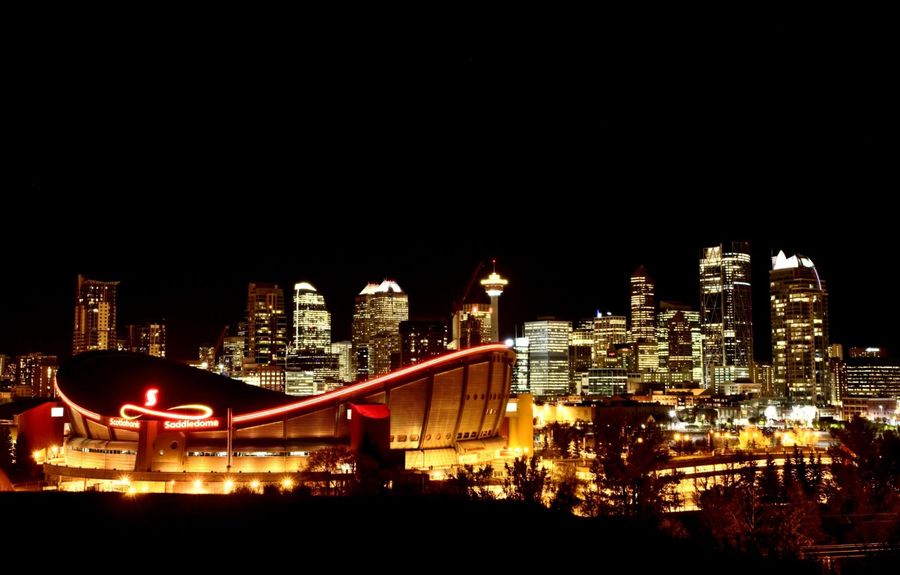

The study predicted that home prices will remain flat throughout the spring market, with several large markets showing signs of slowdown. Home prices in the Greater Vancouver area are expected to fall 1.4% over the next quarter, and economic activity in Alberta is forecasted to remain sluggish, with the aggregate price of a home in Calgary, Edmonton, and Fort McMurray falling marginally by 1.5%, 1.0%, and 0.8% to $468,974, $371,782 and $576,211, respectively.

On the other hand, the market is expected to be slightly better in Ontario. Ottawa is expected to post the highest price appreciation during the spring market and is forecasted to rise 2.8% to $482,459 during the second quarter. In fact, the aggerate price of a home in Ottawa has now surpassed that of Calgary for the first time.

Read more:

In Toronto, median home prices 5.8% year-over-year in the first quarter of 2019. Two-storey home prices and bungalow home prices rose 4.8% and 2.5% year-over-year, respectively, while condominium prices rose 9.3% year-over-year.

“We are expecting this to be a sluggish year overall in Canada’s residential real estate market, with the hangover from the 2018 market correction and weaker economic growth acting as a drag on home price appreciation, balanced by lower for longer interest rates,” said Phil Soper, president and CEO, Royal LePage. “There is a silver lining here. This slowdown gives buyers, and first-time buyers in particular, an opportunity to buy real estate in our country’s largest cities.”

Duffie is an award-winning writer and managing editor of Key Media’s Manila editorial team.

Originally a visual arts journalist, he has covered important international art events – including the biennales of Venice and Singapore and Art Basel – for various regional and global publications. He now contributes to Key Media’s diverse stable of business titles across different markets, including Mortgage Professional, Insurance Business, and The Educator.