When you buy a property, unfortunately, your spending doesn’t end there. No matter where you are, there are going to be some recurring costs associated with your investment. In addition to taxes, you may pay on the closing of your property, such as the Land Transfer Tax, there is also a regular tax devoted to property ownership in general. This is aptly called property tax.

In this article, we are going to explain how property tax works in the City of Toronto. We will cover current property tax rates in Toronto, where the money goes, how rates change over time, and how they compare to other cities.

If your property isn’t in Toronto, this article can still be helpful to you. Most cities handle property tax similarly, it is mostly the rate that changes. In addition, we will be looking at the values for residential taxes. Rates vary depending on the type of property you own. For a full breakdown, consult the city’s property tax information webpage.

What is property tax?

Property tax is all in the name. Homeowners pay this tax to their municipality upon the value of their property. Property tax rates are expressed as a percentage, usually around 1%. Property tax rates directly determine your annual property tax payments (we will get into more specific calculations later).

This does not mean that you have to pay your property tax bill all at once though. In Toronto, you will pay your property tax bill in instalments. You can pay as few as two instalments per year, or as many as 11 if you enrol in the Pre-Authorized Tax Payment Program.

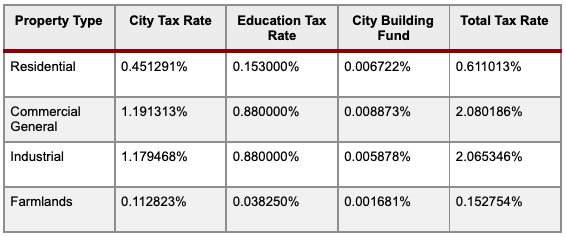

The current property tax rate for residential properties in the City of Toronto is 0.611013%. Property tax rates for other property types will vary.

Why do I need to pay property tax?

When you purchased a property in a given municipality, you implicitly agreed to be subject to the laws and practices of that municipality, and this includes property tax rates. If you don’t, the city can take action against you (actions which you may pay for as well).

That isn’t to say that property tax is just money down the drain. There is a good chance that you enjoy the benefits of the municipality your property is located in. Property tax revenues make up the primary source of revenue for many cities.

With the money collected through property tax, the city is able to construct and maintain the many infrastructures and public works projects that a city requires. This includes building roads, libraries, and transit systems such as the TTC.

The City of Toronto even provides a breakdown of where your tax money was allocated. They base their chart on an average property value in the city ($703,200) in order to give you a realistic idea of how your money is spent.

In 2020, the city’s largest expenditure was police services, costing over $1 billion per year, or around $738 per property. In second place is the TTC, costing the taxpayer about $541 on average.

Property Tax rates in Toronto

The final percentages of property tax rates are determined by a few different values. First, there is the city or municipality tax rate. This is determined by your municipality and often makes up the largest part of your taxes. In Toronto, the current city tax rate for residential properties is 0.451291%.

Next is the Education Tax rate, which is set by the province and goes towards local schools and school boards. The Education Tax rate is currently set at 0.153000% for residential properties.

Finally, Toronto applies an additional City Building Fund Levy of 0.006722%. This newer portion of taxes goes towards affordable housing projects, TTC maintenance, and other projects designed to keep the city in good shape in the coming years.

Adding these three pieces together, we get a residential property tax rate of 0.611013% in the city of Toronto.

Property tax rates are usually set yearly by the city council to reflect the city’s needs.

How property taxes are calculated

Your payment is based on the assessed property value of your home. Property assessment values are determined by the Municipal Property Assessment Corporation and are updated every year. This value is then simply multiplied by the property tax rates to determine your yearly contribution.

An example:

For a property assessed to be worth $720,000 in 2021.

Using the formula:

Estimated property tax = Assessed Value x Total Tax Rate

your property tax for the year will be approximately:

$720,000 x 0.611013% = $4,399.2936

Therefore you can expect to pay an annual property tax amount of about $4,400.

Your Property tax account

Every property owner in Toronto has a property tax account. This account can provide you with information regarding transactions, payments, and payment schedules. You can easily review your property tax account online through the city’s web portal.

Average Property tax: Toronto compared to other Ontario cities

Tax rates in Ontario can vary greatly. Generally, municipal tax rates reflect the size of the region, the council’s operating budget, and the state of the city’s property market, among other factors. This is why Toronto, with a very large number of expensive properties and more taxpayers generally, tends to have the lowest rates in the province.

A report by Zoocasa determined that Toronto, Markham, and Richmond Hill had the lowest property tax rates in Ontario, while Windsor and Thunder Bay had the highest property tax rates in Ontario. The report compares actual payments based on sample assessment values for properties, showing an average price for taxes in each city.

How property tax rates reflect the housing market

Generally, the areas with the most expensive properties will have the lowest property tax rates. Conversely, an area with the lowest priced real estate will tend to have the highest property tax rate. Windsor has a property tax rate of 1.818668%, however, the city also has a considerably lower average home price than Toronto or Richmond Hill who have overall lower tax rates. This means that while people in Windsor will pay less for a home upfront, but pay more for it over time.

Residential property tax can also be affected by the commercial rate that businesses pay. A municipality that is able to derive more tax income from commercial real estate will often have a lower residential tax rate.

How do property taxes change?

Property taxes usually change every year, but they do not always necessarily increase. The rate in any given year will depend on the needs of the city at that time. For example, Toronto had a higher property tax rate in 2018 than it does today. The property tax rate in Toronto from 2018 to 2020 actually decreased but increased again this year. This is due in part because as property assessment values increased in recent years, tax revenues increased and allowed the rates to drive lower.

Take the Toronto City Building Fund as an example. This addition to property tax was not always part of your payment. Rather, it was added in recently to address an assessment that the city would need additional income to raise sufficient cash for improvements and maintenance in the coming years. This value could change depending on if the city needs more money than it thought, or less than they initially calculated.

What does property tax mean for investors?

If you are buying a property as an investment, the sale price is just one financial consideration you need to keep in mind. There are many other costs involved, of which property taxes is just one. Between two municipalities, the difference paid annually can amount to thousands of dollars. Unexpectedly high property taxes can ultimately take a portion out of your return. Always inform yourself on local tax rates and consider your lifestyle and financial needs before you buy a property. Toronto and other municipalities offer the most up to date information on their websites.

If you buy property in an area with the highest property tax rates, you may save on property value, but these savings are not as good as they seem after you pay high property taxes.

Corben joined CREW as a relative newcomer to the field of real estate and has since immersed himself and learned from the experts about everything there is to know on the topic. As a writer with CREW, Corben produces informative guides that answer the questions you need to know and reports on real estate and investment news developments across Canada. Corben lives in Guelph, Ontario with his partner and their two cats. Outside of work, he loves to cook, play music, and work on all kinds of creative projects. You can contact Corben at corben@crewmedia.ca or find him on Linkedin at https://www.linkedin.com/in/corbengrant/.